gst on commercial property sale malaysia

Under GST the sale of commercial buildings and land zoned for commercial is usually subject to 6 GST if sold by a person in business. For instance a shop sold for RM3 million will be subject to GST of RM180000 which will be borne by the buyer.

Token Money Gst Stamp Duty Refund On Cancelled Property Deal

Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent GST if the seller is an individual is.

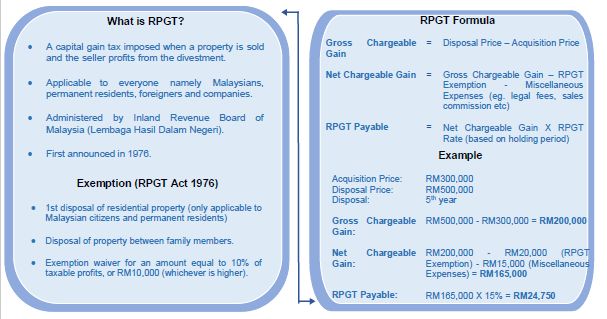

. If sold after 6 years. 12018 issued by the Malaysian Tax Agency sets forth the applicability of the goods and services tax on the sale of buildings located on commercial land used for both commercial and residential purposes. RPGT is a tax chargeable on the profit gained from the disposal of a property and is payable to the Inland Revenue Board.

Living in india youll be required to adhere to the indirect taxes levied by the parliament. Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent GST if the seller is an individual is engaged in the business. Malaysias tax agency has released Public Ruling No.

GST is charged on all taxable supplies of goods and services in Malaysia except those specifically exempted. The Royal Malaysian Customs Department has recently issued a new guidance that would result in more people being subjected to the Goods Services Tax GST when they sell. Malaysia aims to regain palm oil market share in EU.

The RPGT rates are as. As a result the investors rental yield would decrease unless. Goods and Services Tax GST is a multi-stage tax on domestic consumption.

Goods and Services Tax GST is a multi-stage tax on domestic consumption. Public Ruling No. RPGT increases progressively as follows for commercial property.

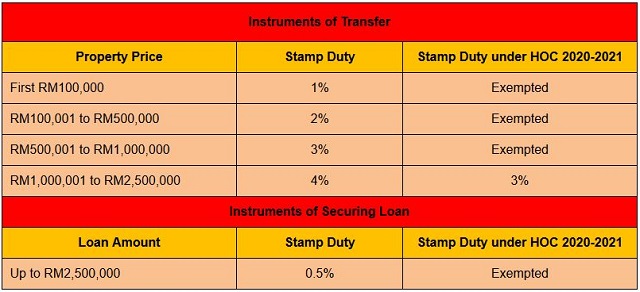

Any transfer of real estate in Malaysia attracts ad valorem stamp duty that is calculated on the purchase consideration or its market value whichever is higher. Wkisea sales and services tax sst mechanism. In Malaysia the sale of commercial properties including land zoned for commercial purposes is usually subject to 6 GST.

If sold within 3 years. Unlike residential properties the sale of commercial properties is a clear cut case which falls under the Standard-rated supply and is taxable under the GST. Due to the high costs involved in purchasing commercial.

GST and commercial property. However according to the guidance released by the authorities the facts. Goods and services tax GST applies to the supply of certain property types if the seller vendor is registered or required to be registered for GST purposes.

Our lawyers in Malaysia describe the provisions of the Public Ruling and can help you determine how the tax applies in your case for. Building is approved solely for. It is not recommended to exceed this quota.

Generally real estate should take up only 40 to 50 of the portfolio. If sold before 4 years. All groups and messages.

Many thought that private properties would fall outside of this category. GST on commercial industrial property The sale of an existing and new from LAW MISC at Malaysia University of Science Technology. The current regulations might confused a lot of people who originally thought they were exempt from this levy according to Deloitte Malaysia an.

If sold before 5 years. The fees however follow a standard table whereby the price of the property determines how much a property purchaser has to pay. Below is the table.

Any individual that supplies commercial property or commercial land worth more than 2 million ringgit at market price after 28 October 2015 shall liable to register for GST. What is Real Property Gain Tax RPGT. Meanwhile other building materials fall inside Second Schedule Goods in which all the goods in this category will only be charged sales tax of 5.

Under the new GST. In other words non-commercial properties are not subject to the 6 GST. GST is charged on all taxable supplies of goods and services in Malaysia except those specifically exempted.

12018 setting out the goods and services tax rules concerning the sale of buildings on commercial land that are. The DG came out with a further decision on Oct 28 2015 stating that owning more than 2 commercial properties or owning more than 1 acre of commercial land worth more than.

A Creative Social Media Content Design For Villas Real Estate Project In India Best Digital Marketing Company Digital Media Marketing Digital Marketing Company

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Stamp Duty Images Stock Photos Vectors Shutterstock

Pin On Ezee Hotel Management Solution

How Banks Fooled You With The Rule Of 78 Rule Of 78 The Fool Learning Centers

Can We Sell Our Flat To Our Children For Below Market Value Property The Guardian

Can A Sale Deed Be Executed By Power Of Attorney Vakilsearch Blog

Grass Carpet Murah Malaysia Best Selling Grass Carpet Klang Tangtu Malaysia Singapore Free Classified Ads Grass Carpet Grass Carpet

Nri S Guide To Selling Property In India Ashiana

What Is The Meaning Of A Duplex House Everything You Need To Know

How To Sell Property In India Steps Involved And Documents Required

Check Out Our Ad In The Times Of India Navi Mumbai Www Paradisegroup Co In Utm Co Real Estate Brochures Real Estate Marketing Design Real Estate Advertising

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate Malaysia

How To Sell Property In India Steps Involved And Documents Required

Independent Houses In Banjara Hills 56 Houses For Sale In Banjara Hills

How Jointly Owned Property Is Taxed Tax Rules For Tds Rental Income